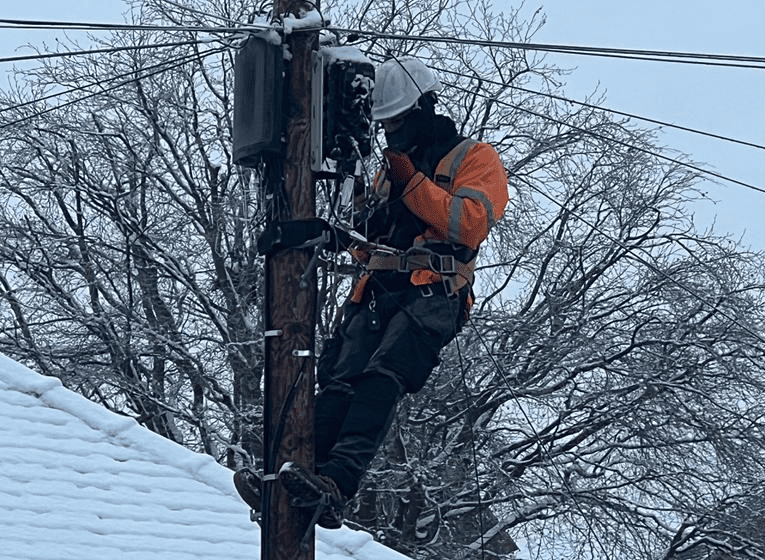

There has been talk in the press of utility outages this winter. Depending on your business this may have several implications, which include;

- Any frozen and chilled stock such as food and medicines will be impacted.

- Some trade processes and manufacturing and engineering systems may need be shut down and re-energised in a controlled manner to prevent damage to the equipment.

- The ability to run night shifts will be increasingly difficult.

- Security systems – CCTV systems, Intruder and Fire Alarms installed to the relevant BS/EN standards will have an uninterruptable power supply, normally by battery back-up which steps in automatically when an electrical power outage occurs. Please check with your supplier/maintenance company. Also ensure your back up supply is healthy as batteries decline over time and do need to be replaced.

Be prepared for planned power outages that exceed the capacity of the back-up power supply, as you may need to consider hiring security or visits to site by staff members. Buy a generator if you need one as they will be hard to get in a crisis.

Putting in place Business Continuity Arrangements

It is always best to be prepared. The more prepared businesses are the less impact emergency situations will have on them.

- Manage your risk management. Install sprinkler systems, minimise risk of a cyber-attack, health & safety procedures etc.

- Plan for the business to continue as much as possible. Outsource arrangements, data back-ups, generators etc

- The Incident Response Plan – the step-by-step playbook for how the organisation manages an incident.

- Recovery resources plan – these are the resources the business needs to operate day to day. This would include incident response centre, key business data and a communications plan.

What is business continuity planning?

Business Continuity Planning is not the same as a Disaster Recovery Plan. Sometimes the two phrases are used interchangeably. Disaster Recovery Plan deals with disasters, rather than the loss of a specific asset or resource, such as electrical supply. Business continuity planning looks at minimising the likelihood of disruption, thus maintaining “continuity within the business” and also being more proactive to recover the business. It focuses on the time frames in which the Business’ functionality is restored, regardless of the cause for its loss or loss of use. Ultimately to get business back to normal as quickly as possible.

Business Continuity Planning includes testing and maintenance to ensure they are in a state of readiness when and if required and all those with a role or responsibility can work on knowing what they will be doing.

For any more information regarding this then please contact our experts.